5 vital things you need to know about lifestyling your pension and why it might not be right for you

June 2021Lifestyling your pension as you approach retirement is common practice. But here are five things you need to know about it, and why it may not be right for you

According to scientists, it may not be wisdom that means we are more risk-averse in older age – it’s chemicals in the brain. That’s according to researchers at University College London who have discovered that levels of dopamine – the natural feel-good chemical in our brain – decreases over time.

This, the study concluded, means that the older we get, the less likely we are to take risks.

While this could be one of the reasons you may want to reduce your pension’s exposure to risk as you approach retirement, there’s likely to be a more straightforward reason. With less time to retirement, a downturn in the markets and corresponding downturn in your pension’s value can feel much more threatening than when you had decades to go until retirement.

While logical, reducing the risk level of your pension investments as you approach retirement also reduces its growth potential, and that may be highly detrimental to your retirement plans and long-term financial security.

Read on to discover why this is, and why any workplace pensions may need to be checked as soon as possible.

1. Historically, reducing your pension’s exposure to risk made more sense

Pension providers tend to reduce the risk level of your pension 5 to 10 years before retirement, something that is known as “lifestyling”. What this does in practice is reduce the stockmarket exposure the closer you get to your chosen retirement date.

Before the introduction of Pension Freedoms in 2015, people tended to purchase annuities with their pension pot at retirement. As you were effectively “cashing in” your pension to buy an annuity – which provides an income for life – it made more sense to reduce the pension’s exposure to risk, as a last-minute downturn in the markets would reduce your pension pot’s value.

If the size of your pension pot fell, then so would the level of income you could buy for the duration of your retirement.

Pension Freedoms legislation was introduced in 2015. You can now potentially access your pension more flexibly, meaning you can keep your pension invested and exposed to growth potential as you draw an income. Not all pensions have the freedoms afforded by the legislation and this is something we can check for you as part of your retirement planning.

As a result of Pension Freedoms, annuities have fallen out of favour.

Data from the Financial Conduct Authority (FCA) reveals 31,138 annuities were purchased in 2019/20, less than 10% of the total number of pensions accessed during the period. Another reason for this decline in popularity is the low levels of income annuities tend to offer nowadays, due to several factors including historically low interest rates.

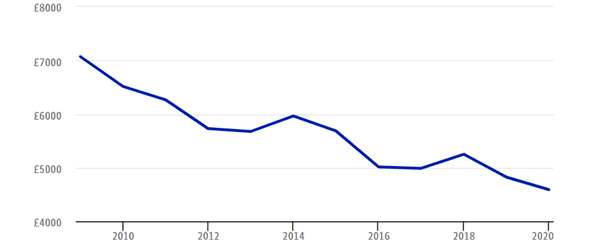

The graph below highlights the drop in income provided by annuities between 2009 and 2020. The illustration shows the income a 65-year-old with a pension pot of £100,000 would be able generate for themselves if they bought a single life annuity from the top provider at the time.

Source: the Telegraph

2. The intention to access your pension flexibly and lifestyling tend not to go hand in hand

If you want to access your pension flexibly, lifestyling is unlikely to be right for you. This is because you are switching your pension to a lower-risk portfolio that reduces its expected growth potential. In turn, that is likely to mean a smaller retirement pot.

This could not only reduce the level of income you can take from your pension pot, but also impacts on its potential longevity. With a reduced pot, you’ll either need to reduce your income or face the prospect of your pension pot running out during retirement.

For this reason, reducing your pension’s potential growth in the years running up to your retirement may not be the right approach.

But it’s not just the loss of growth before you retire. Lifestyling means your pension remains in a lower-risk portfolio during your retirement and, again, this could have significant implications.

Your retirement could last for 20, 30 or even 40 plus years. If you retain your cash in a low-risk portfolio for decades, it’s likely that you will suffer from lower growth than if you considered a portfolio with a higher exposure to the stockmarket.

Retaining your pension in a low-risk portfolio could therefore curtail future growth, which may mean that you’re more likely to run out of money in your retirement.

3. Portfolios with higher stockmarket exposure can also inflation-proof your pension

Another reason reducing the risk of your pension pot could cost you dear is inflation. This is the increased cost of living, and if your pension is not keeping pace with it, it will decrease in value in real terms.

In May 2021, inflation stood at 2.1%, up from 1.5% the month before. The following illustration shows that if inflation averages 2% over the next 10 years, you’ll need £121.90 in 2031 to have the same spending power as £100 today.

Source: CPI Inflation Calculator

Keeping your pension exposed to greater growth potential by maintaining a higher stockmarket exposure can help inflation-proof your retirement. Our recent blog, 3 practical reasons cash savings could cost you dear, explains how remaining invested in higher-risk portfolios typically provides better returns in the long-term.

It refers to the 2019 Barclays Equity Gilt Study, which tracked the nominal performance of £100 invested in cash, bonds or equities between 1899 and 2019 and shows that £100 invested in cash in 1899 would be worth just over £20,000 in 2019.

Not bad you might think, until you learn that if the money had been put into stocks and shares, it would have been worth around £2.7 million in 2019. Over the long term, the returns of higher-risk portfolios are likely to be greater than any increase in inflation, this protects the value of your pension in real terms.

4. Typically, don’t lifestyle if you’re not taking an income from your pension

If you have savings or other investments you can live off in retirement, it’s worth remembering that pensions typically fall outside of your estate for Inheritance Tax (IHT) purposes. This typically means your pension is not liable to the tax upon your death, which is usually charged at 40%.

Savings and investments may fall into your estate, so using these up first is often the better IHT strategy as it helps reduce, or even negate, any IHT liability.

With this in mind, leaving your pension exposed to higher-risk investments and greater potential growth could allow you to leave even more money to loved ones in a tax-efficient way when you die.

5. Beware of lifestyling if you intend to carry on working

If you do continue to work in retirement, and do not intend to draw on your pension pot – or will be drawing a reduced income – lifestyling is unlikely to be appropriate.

Remaining in a higher-risk fund that exposes your pension to greater growth could allow your pot to increase, meaning it can provide a higher income when you do fully retire, and extend its longevity.

Always speak to us if you are going to work and draw an income, as there are little-known tax regulations that could impact on you and any future contributions you want to make to a pension.

Check whether your work pension scheme uses lifestyling

Many workplace pension schemes use lifestyling, so be careful. It’s important to check whether this is the case with yours and, if it is, whether it’s the right thing for you. For all the reasons explained above it may not be, and we’d be happy to confirm the situation and explain your options.

Get in touch

We are always here for you, so if you want to discuss your pension, the issues around lifestyling or tax implications of any income you’re thinking of taking, please contact us.

Please note

Investments can fall as well as rise, and past performance may not be a reliable guide to future results.

Share the article

Contact us

42-44 Rosemary Street

Belfast, BT1 1QE